capital gains tax proposal effective date

The tax on capital gain of property transferred by gift or at death would be effective January 1 2022. Dems eye pre-emptive capital gains effective date.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of.

. The Green Book says this. Additionally the proposal related to the repeal of section 1031 applicability to gains in excess of 500000 per taxpayer would be effective for exchanges completed in tax years beginning after December 31 2021apparently regardless of the date upon which the exchange may have begun. Which leads to the oft-asked question of when.

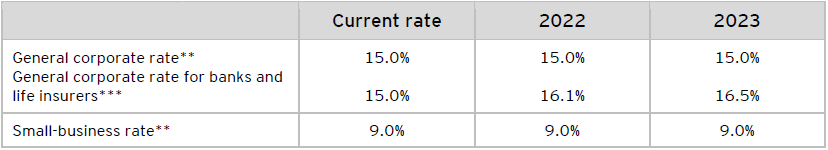

Taxpayers can also consider other rate arbitrage opportunities as Democrats are largely proposing effective dates of Jan. Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023. KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when.

On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. The proposal would be effective for gains recognized after the undefined date of. 1 2022 or later for most other proposed changes.

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. The effective date for most of the proposals is Jan. In short we dont yet know the answer to this important question.

No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the Green Book notes an effective date of April 2021 or the date of announcement. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021. Bidens Capital Gains Proposal.

Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. As you review this alert it is critical to keep in. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it.

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37 percent being the highest rate 408 percent including the net investment income tax.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. If this were to happen it may not only seem unfair but it is also bad tax policy. This proposal would be effective for gains required to be recognized after the date of announcement.

This is a total of 1124000 additional tax. Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate.

Effective Date Considerations May 14 2021. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of.

These provisions would be effective January 1 2022 except the tax rate on capital gains which would be effective April 28 2021 the date that the AFP was released by the White House. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. 13 2021 unless pursuant to a written binding contract effective on.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Bidens Capital Gains Proposal. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. In somewhat of a surprise the budget request assumes that the proposed capital-gains-related changes would be enacted retroactive.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

A Simpler Theory Of Optimal Capital Taxation Sciencedirect

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

How To Write Out A Bill Of Sale Opinion Of Experts Bill Of Sale Template Word Template Business Template

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Tax Measures Supplementary Information Budget 2022

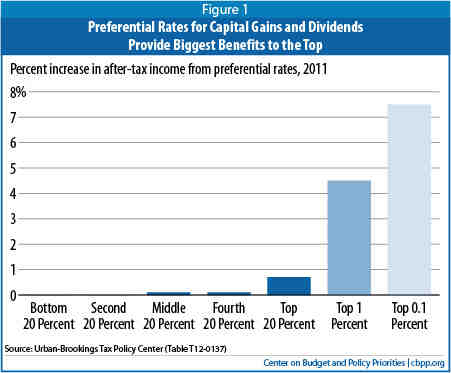

Raising Today S Low Capital Gains Tax Rates Could Promote Economic Efficiency And Fairness While Helping Reduce Deficits Center On Budget And Policy Priorities

Biden Tax Plan Corporate Capital Gains And Income Hike Uncertain

Archived Tax Planning Using Private Corporations Canada Ca

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends